Sift

shift

au Commerce & Life, Inc.

93% reduction in chargebacks and 75% reduction in manual review time in one year of operation Continue to grow with anti-fraud measures that do not impair the customer experience

POINT

Flash sale type EC site "LUXA" that sells premium products and services at special prices for a limited time under the theme of "expensive luxury experience". It has gained the support of relaxed adults who want to enjoy a little luxury in their daily lives, and has achieved steady growth among the KDDI CORPORATION 's e-commerce businesses. However, in the summer of 2018, fraudulent use of credit card transactions, which are the main payment method, temporarily increased to 3 million yen per month. introduction. Three months after the introduction, we were able to reduce unauthorized use to less than 1/10.

au Commerce & Life, Inc.

CX Promotion Division Customer Service Promotion Department

Mr. Keita Takahashi

au Commerce & Life, Inc.

CX Promotion Division Customer Service Promotion Department

Direct Customer Service Group

Mr. Ryuhei Otsuki

Credit card fraud suddenly increased 20 times

An experience ticket for "LUXA", which provides luxury as an "experience" at a low price, such as all-you-can-eat at a slightly rich shop and a premium course of a high-end beauty treatment salon. Users can enjoy it at a good price, and the store that provides it can approach prospective wealthy customers. “LUXA” has grown with the support of both sides. Wealthy users are also attractive targets for retailers who open stores. Currently, both product sales and experience ticket sales are growing, and they continue to grow steadily on an annual basis.

Credit cards are the most used payment method for LUXA, and approximately 70% of sales are settled. However, since around June 2018, there has been a sharp increase in fraudulent use of credit cards. "Chargebacks (sales cancellations by credit card companies due to fraudulent use by third parties), which used to be about 150,000 yen per month, jumped to 3 million yen per month." (au Commerce & Life Takahashi Mr). The purchase price for goods and services was paid as usual, but the sales were canceled by the credit card company on the grounds of fraudulent use, which was a situation that could not be overlooked as a business. Chargebacks suddenly increased 20 times, and the acquirer (credit card member store contract company) strongly requested measures against fraudulent use.

After examining the introduction of various anti-fraud measures, we arrived at "Sift"

At that time, credit card transactions were already required to enter a security code, but fraudulent use could not be sufficiently prevented. ``After visual inspection by the person in charge, we stopped shipments of large-scale purchases of the same product, high-value transactions of several hundred thousand yen or more, and large-volume purchases of products with high liquidity such as home appliances, watches, and precious metals. However, the number of chargebacks did not decrease as expected.” (Mr. Takahashi)

Additionally, we considered introducing 3D Secure for personal authentication. However, there were concerns that users would leave the site and sales would decline if they had to enter their passwords on the authentication site dedicated to 3D Secure. There were objections from within the company to the fact that the customer experience when shopping was impaired, and as a result, the introduction of 3D Secure was postponed.

Therefore, we considered the introduction of an unauthorized use detection service that does not degrade the customer experience. In "LUXA", we tried Sift and another service in parallel and decided to adopt Sift. There are three reasons why I decided to hire him.

The first reason is that Sift had higher detection accuracy. Sift uses artificial intelligence to machine-learn patterns of fraudulent use of credit card transactions. The person in charge gave information on normal transactions and fraudulent use for about 3 weeks, allowing Sift to learn.

The second reason is the usability and extensibility of the management screen. “Compared to the other service, Sift was easier to operate and I didn’t feel stressed about using it. I felt that it was highly flexible and easy to use, such as being able to directly extract transactions.” (Mr. Otsuki) The aim was to automate the suspension of product shipments. Therefore, it was also a point that Sift, which can be easily linked with API, was easier to develop.

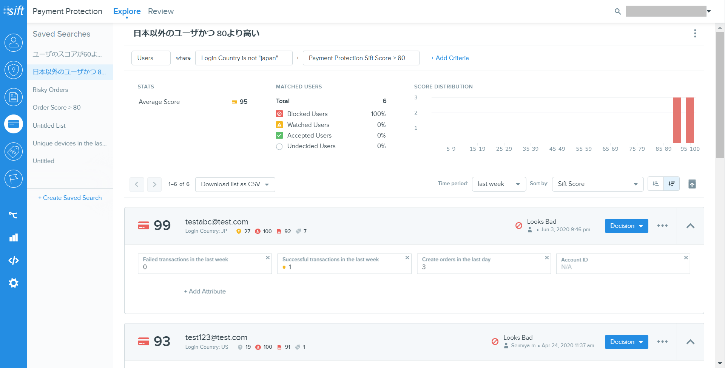

Sift management screen example (1)

A screen used for visual checks for fraudulent use.

Only relevant transactions and users can be extracted according to preset conditions.

The third reason is Sift's behavioral analysis capabilities. Sift can set up checkpoints by embedding simple codes in each page of member registration, product selection, and payment along the user's purchasing flow. It is possible to measure the dwell time between checkpoints and determine that extremely short cases are unauthorized use by bots rather than human operations. It is said that customized development was necessary to achieve the same thing with the other service that was being compared.

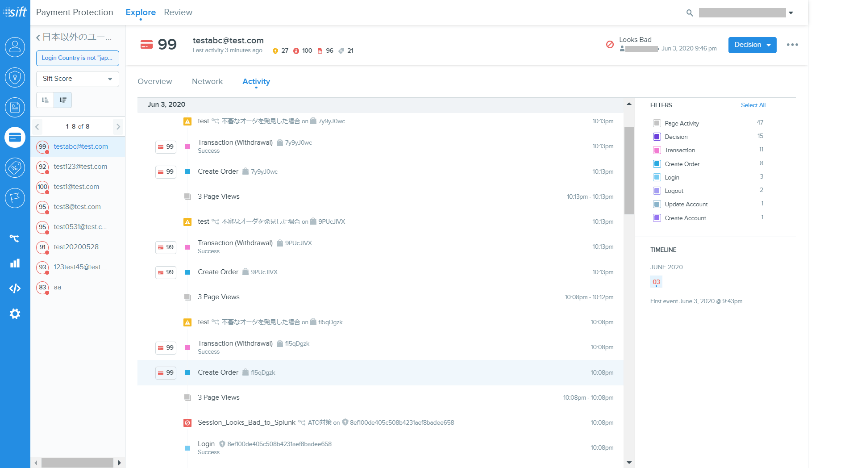

Sift management screen example (2)

Analyze behavior such as page transitions and stay time for each user.

Scores for each action and workflow (rules set for fraud detection)

Application status can be checked

Immediately after introduction, we reduced chargebacks of more than 7 million yen and decided to automate

"LUXA" first introduced "Payment Protection," which judges fraud for each individual transaction. Send names, addresses, partial credit card numbers, device information, and more to Sift to score each transaction. The higher the score, the higher the possibility of fraudulent use.

For implementation, technical support from Macnica was utilized. "Sift's technical support is in English, so it was very helpful for Macnica to step in and make adjustments," said Otsuki. He said he had no concerns as the legal department carefully reviewed the contract.

For about three weeks after the introduction, after letting Sift perform machine learning for about two hours a day, the person in charge first reviewed transactions with a score of 80 points or higher, discovered fraudulent use, and started operation to manually stop transactions. In the three months from September to November after the introduction, fraudulent use of 7 million to 9 million yen was detected and chargebacks were prevented. Chargebacks in December during the Christmas season of the same year decreased to 250,000 yen per month, less than 1/10 compared to before the introduction of Sift.

Since we were able to confirm that Sift's detection accuracy was sufficient, we began developing the system that we had originally envisioned, automating the suspension of shipments for transactions with high scores. With support from Macnica, we developed the system almost entirely in-house, and were able to release it in about three months.

Significantly reduced work time to respond to unauthorized use

Currently, Sift calculates a score for each transaction, and if the score is 70 or more, it is regarded as fraudulent use and shipment of the product is automatically suspended. Transactions with a score of 10 to less than 70 are put on hold for a visual check by the person in charge, but only about 5 out of around 2,000 transactions per day are actually put on hold. Verification usually takes less than 30 minutes per day. “Before the introduction of Sift, it took 30 minutes to an hour to take action to stop the shipment if fraudulent use was detected, and we were always pressed for time. Since it is not progressing, the workload of the person in charge has been greatly reduced.” (Mr. Takahashi)

After operating "Payment Protection" for about three months, fraudulent use steadily decreased, so the next step was to adopt "Account Defense" to prevent the registration of fraudulent accounts. The created account is scored based on information such as the email address and name entered when creating a new account and terminal information. If the score is high, the account is not automatically allowed to register. "We have 10,000 to 20,000 account registrations per month, but we have never received any complaints from users. I think this means that we are able to identify fraudulent registrations with such a high degree of accuracy," said Mr. Takahashi. evaluate.

Expectations for an increase in the number of companies that have introduced Sift

About a year has passed since LUXA began automating unauthorized use detection and shipment suspension by Sift. In the meantime, the judgment accuracy has been further improved by letting Sift machine-learn the information of the transaction that caused the chargeback. As of April 2020, chargebacks were about 200,000 yen per month, a decrease of about 93% from before the introduction of Sift. “Even though it’s called machine learning, it’s a task that anyone can do by searching the dashboard for transactions subject to chargebacks and specifying them. (Mr. Otsuki) The introduction of Sift will not increase the number of purchase steps or hinder the customer experience. There is no negative impact on sales, and it is said that there is a sufficient reduction in fraudulent use against Sift's service usage fee.

Also, the amount of fraud detected by Sift continues to decrease. According to Takahashi, the reason for this is that "prevention of large amounts of fraudulent use has created a virtuous cycle in which fraudulent criminals are less likely to be targeted." It is said that Sift can also prevent list-type attacks (spoofing legitimate users by hijacking IDs and passwords), which have been increasing in recent years.

“I think that the number of companies that will introduce Sift in Japan will increase in the future.I have heard that there is a Sift user community in the United States, but in Japan, Macnica is also planning to establish a user group where companies that have introduced Sift can share know-how. I hope it will be held by the organizers.'' (Mr. Takahashi)

Unauthorized use of credit cards on domestic EC sites continues to increase. In fiscal 2019, the amount of damage exceeded 22 billion yen, the largest ever. The credit card industry is grappling with this as a major problem that will shake the credibility of the entire credit card industry, and is currently searching for effective measures. The expansion of companies using Sift is expected to put a brake on that trend and bring about further growth in the EC market.

User Profile

| au Commerce & Life, Inc. | |

|---|---|

| location | 1-23-21 Shibuya, Shibuya-ku, Tokyo Shibuya Cast 11F/12F (Reception) |

| URLs | https://www.au-cl.co.jp/ |

Inquiry/Document request

In charge of Macnica Sift Co., Ltd.

- TEL:045-476-2010

- E-mail:sift-sales@macnica.co.jp

Weekdays: 9:00-17:00