Sift

shift

Fraud prevention and machine learning platform

Online fraud prevention solution that protects against online fraud with machine learning

Machine learning instantly identifies whether a transaction partner is a trustworthy user on EC sites and the Internet. Online fraud can be prevented by real-time detection of users engaging in account hijacking, impersonation, use of stolen credit cards, creation of fake accounts, and distribution of spam and illegal content.

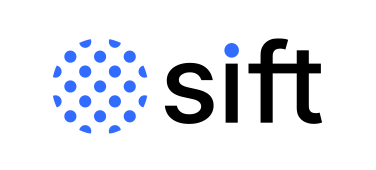

Strength ①: Highly accurate risk determination

Machine learning automatically learns fraud trends and calculates risk values. Fraud trends are determined by combining Sift's global knowledge with what is learned for each service, making it possible to make highly accurate judgments that are appropriate for each service.

Sift holds over 16,000 features based on data accumulated worldwide. Risk judgments are made by combining the necessary features on the data that is actually sent, such as the characteristics of the accessing device, the entered email address, member information, and shipping address. (Score link from 0 to 100)

It also combines several types of machine learning models and performs calculations with the optimal engine. The learning model is optimized not only based on globally shared features but also based on the customer's environment.

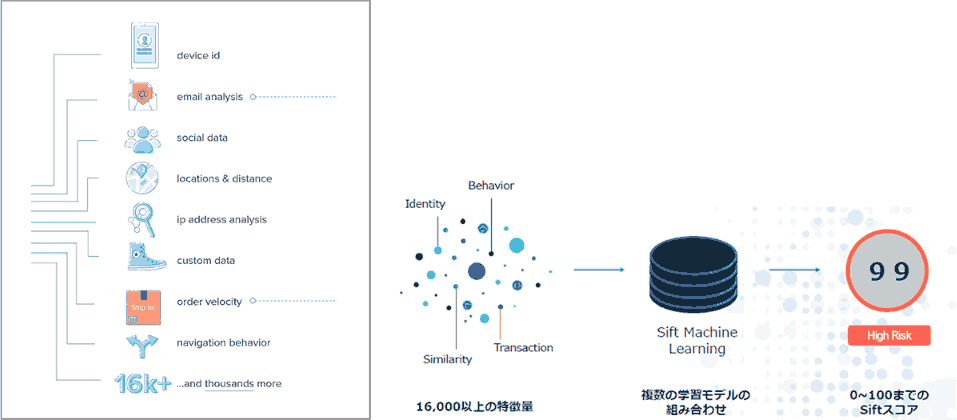

Strength ②: Simple anti-fraud operation that does not require rule tuning

Automatically learns fraud trends by providing feedback based on actual data. Feedback can be provided with a single click or can be automated, making it possible to implement fraud countermeasures while reducing operational burden.

Strength 3: Flexible implementation of business logic

You can build business logic based on various conditions from the Sift management screen. There is no need to implement complex business logic on the EC system side.

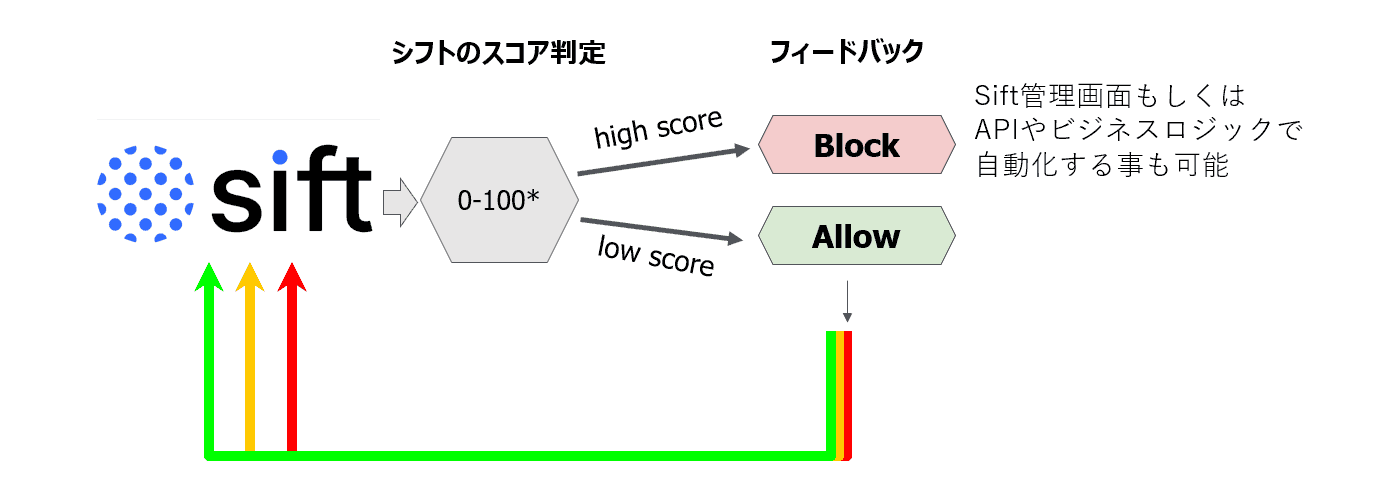

[Product 1] Payment Protection

Anti-fraud solution. Efficiently detect fraudulent payments by machine learning trends in fraudulent payments on EC sites.

[Product ②] Account Abuse

It is a countermeasure solution for fraudulent account use. Machine learning of fraud trends to detect fraudulent use of applications.

[Product ③] Account Defense

An account takeover solution. High-precision fraud detection prevents account takeovers without compromising the convenience of legitimate users.

Case study

Sift - User case study -au Commerce & Life, Inc., Ltd.

93% reduction in chargebacks and 75% reduction in manual review time after 1 year of operation

Sift - User Case -Loco Partners, Inc.

Hundreds of “fraudulent accounts” were successfully discovered in “Relux”, a hotel and ryokan accommodation reservation service, and the amount of chargebacks decreased by about 60% in one year.

Sift - User Case -Yoshinoya, Ltd.

Yoshinoya sells “Yoshinoya Beef Bowl” on its own EC site, where you can enjoy the taste of the store at home. The number of chargebacks has decreased to less than 10% due to the introduction of the "fraud prevention service (Sift)", and both the growth of the EC site and the "security that prevents baskets from being dropped".

Seminar

これから開催 開催終了 {{ item.title }}

{{ item.seminar_start_date__display_1 }} {{ item.seminar_place__display_1 }}

video on demand

company description

| company name | Sift, Inc. |

|---|---|

| Established | 2011 |

| location | United States San Francisco |

| representative | Jason Tan |

| website | https://sift.com/ |

Inquiry/Document request

In charge of Macnica Sift Co., Ltd.

- TEL:045-476-2010

- E-mail:sift-sales@macnica.co.jp

Mon-Fri 8:45-17:30

![Yoshinoya EC team's digital strategy and tool utilization learned from failure [MND2021 lecture video]](/business/security/sift/image/sift_ondemand_bn03.jpg)